The Main Principles Of Penalties For Driving Without Car Insurance By State - Kelley ...

If your state penalties vehicle drivers for passing up protection, you will likely need to pay the fine even though you did not create the crash. car insurance. Once more, a police officer might choose to take your vehicle once they find that you were driving https://questions-car-insurance-calculator.s3.eu-central-1.amazonaws.com/index.html without insurance coverage. Automobile damages is not always the result of accidents when driving.

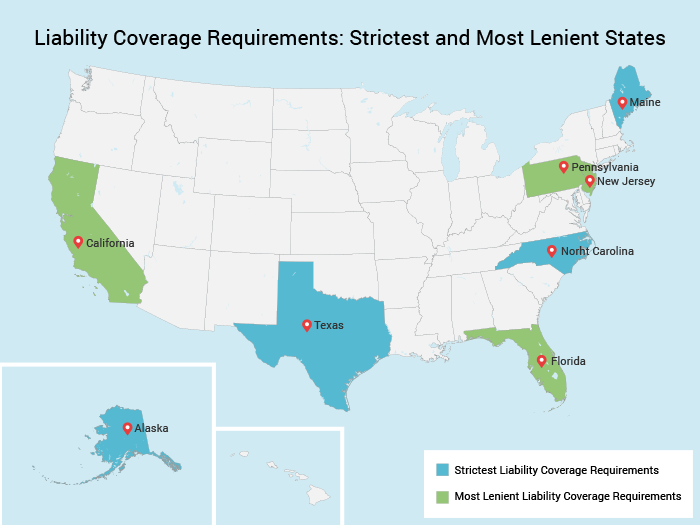

These are the only states in the country that don't need you to carry a minimum quantity of automobile insurance. It is necessary to keep in mind, though, that while you might stay clear of being punished by these states for not having auto insurance coverage, there might be specific parameters you need to meet. And also, you can still deal with particular repercussions if you get involved in an accident or are an at-fault driver.

credit score cheap insurance auto insurance

If you do not follow either the state's insurance coverage or the state's financial responsibility needs, you take the chance of having your permit and also registration put on hold, whether or not you're at mistake in the crash. Just how to discover budget-friendly vehicle insurance, Vehicle insurance policy might not be one of the most amazing purchase, yet it is a fundamental part of your financial plan.

If budget plan is your main issue, there are methods to save on your auto insurance coverage. In enhancement to price, you can likewise compare the readily available protections, discount rates and also consumer service scores of each company.

9 Easy Facts About Insurance Requirements For Maryland Vehicles - Pages - Mva Described

This is due to the fact that if you have had a crash in the past, insurer find it more probable that you will certainly trigger an additional one in the future (car). Keeping a clean record can assist you avoid additional charges on your policy. Raise your deductibles, If you have complete insurance coverage, you have 2 deductibles on your plan: one for thorough and also one for collision.

insured car trucks auto insurance vehicle

The most affordable business for a single person might not be the most affordable company for someone else. Getting quotes from a number of firms can help you locate a lower valued policy, however, so that you can change your insurance policy to a less expensive service provider. If an additional chauffeur strikes you and also they do not have insurance, you have a couple of choices.

You can likewise look for lawsuit as well as file in court against the at-fault motorist for stopping working to reveal proof of insurance policy as well as creating a mishap as a without insurance vehicle driver. Yes, in any kind of state that has a demand for minimal coverage, it is illegal to drive without insurance coverage (suvs). Nonetheless, some states have "financial duty legislations" that permit chauffeurs to show they have the ability to manage the economic aftermath of an at-fault accident without insurance policy.

In these states, car insurance policy is simply one way to please the requirements of the legislation, and if commonly the simplest and most typical means - dui.

Our Oregon Department Of Transportation : Insurance Requirements Ideas

Greet to Jerry, your new insurance coverage representative. We'll call your insurer, evaluate your existing strategy, after that locate the insurance coverage that fits your needs and saves you money.

In the United States, auto insurance laws are a state-level decision. When it comes to car mishaps, a state can choose to be a no-fault state, a tort liability state or a combination. Comprehending the differences between these requireds can appear complicated, but we've damaged down both main classifications, no-fault and also tort, to assist make it easier.

You might require no-fault car insurance, and also having the appropriate amount of no-fault car insurance policy might indicate the distinction between being well-protected or being vulnerable to a legal action or pricey out-of-pocket expenditure. cheapest car. What does a no-fault state suggest? Motorists have insurance policy to cover their own injuries and damages instead than guaranteeing to pay to the various other individual.

In no-fault accident states, vehicle drivers are required to have individual injury protection coverage as component of their auto insurance coverage policy. The regulations bordering car mishap legal actions in no-fault vehicle states are strict.

Where Is Car Insurance Mandatory? - Autoinsurance.com - The Facts

Whoever is at-fault is additionally responsible for the damages brought on by the accident. No-fault states require various vehicle insurance coverage. Right here are the key differences in insurance coverage demands for no-fault states: No-fault insurance coverage spends for clinical expenses utilizing personal injury protection (PIP) protection. Residential property damages are based upon that is liable in no-fault automobile crash states.

The insurance business of the chauffeur that causes the accident is liable for damages. Pros, Disadvantages No-fault states likewise call for PIP coverage (business insurance). Obligation insurance coverage does not secure your auto. You likely don't need to sue with your insurance provider in an at-fault insurance state if the accident was created by another person, conserving you paying a deductible or higher costs.

This is a concern you can look into online as well as verify by asking insurance policy companies in your state. liability. If you live in Kentucky, New Jersey or Pennsylvania, ask regarding option no-fault insurance policy. This puts on states that permit drivers to choose in between a no-fault policy or a conventional tort (or at-fault) plan.

If they select standard tort, they are pulling out of no-fault. Unlike no-fault insurance policy, tort insurance coverage calls for that the legislation assigns "mistake" as well as the person that is at mistake is accountable for all medical expenses, discomfort as well as suffering and damage. You may have heard this sort of insurance policy described as "at-fault". cheap auto insurance.

Indicators on Pay Less For Auto Insurance - Credit Karma You Need To Know

Vehicle insurance coverage will compensate to the limitations the insured picks, however if the limitations are worn down, at-fault vehicle drivers are still liable to pay out of pocket. Currently, 38 states (all states that are not no-fault) are tort liability states. Ensure you know whether you'll be driving in an at-fault or no-fault cars and truck insurance policy state.

A no-fault insurance coverage state sees less unimportant lawsuits because of the limitations enforced on filing a claim against somebody after a collision. When buying auto insurance, there is even more to think about than what service provider you'll select and also what your insurance deductible and premium will certainly be. automobile. It is likewise essential to comprehend the automobile insurance coverage laws in the state you stay in or any state you intend to relocate to.

There are also a number of states who take a hybrid approach by supplying option no-fault. Be prepared to ask your insurance coverage service provider these important questions to ensure you have adequate insurance coverage for your state. cheapest auto insurance.

Auto Insurance Coverage Fees by State According to the Insurance Policy Info Institute (III), the typical car insurance coverage price in 2017 was $1,004. Because different elements impact automobile insurance policy rates, such as postal code and asserts history, vehicle insurance prices range states. So, also if you stay in the least expensive state or one of the more costly states, your insurance rate could be different than the national average.

3 Simple Techniques For Driving Without Car Insurance - The Ansara Law Firm

Due to the fact that the aspects insurance companies take a look at impact each person in a different way, cars and truck insurance policy costs will differ. Which State Has the Greatest Auto Insurance Coverage? Louisiana had the greatest typical vehicle insurance cost of $1,443. According to the current III information, that's about $439 extra costly than the national average. Which State Has the Lowest Auto Insurance Policy? Maine had the lowest ordinary vehicle insurance rate, according to the most recent information from III.

When states require different vehicle insurance coverage laws and also insurance coverages, there can be a lot to keep in mind when you're obtaining a plan. We've made it very easy for you to obtain automobile insurance policy info for your state. Usual Questions Concerning State Cars And Truck Insurance Coverage What Other Aspects Impact Your Vehicle Insurance Policy?

Although chauffeurs don't need to lug insurance policy in both states, they're still accountable for damages if they're entailed in an at-fault mishap. This can put your individual possessions in jeopardy, so it is necessary to obtain the best protection to assist safeguard you on the roadway - accident. Can I Make Use Of Car Insurance From Another State? Yes, if you have an active car insurance plan, it will take a trip with you to other states.

Cars and truck insurance coverage helps safeguard you by paying for car repair work as well as injuries if you remain in a crash. Driving without it is risky. If you do not have insurance, you might be responsible for accident-related costs if you're at fault. And also if that's okay sufficient, most states have fines for driving without cars and truck insurance coverage.

Minimum Car Insurance Requirements By State - Questions

Individuals generally recognize the charges for speeding or driving under the impact of alcohol or medicines. However not everyone understands that if you drive without insurance policy, you'll likely have to pay a penalty, as well as the state may suspend your license and/or registration. You might also encounter jail time in some states, as well as penalties usually obtain a lot more serious if you have numerous offenses (cheapest).

Liability protection is the most usual vehicle insurance need. Numerous states mandate various other kinds of cars and truck insurance that might include uninsured and underinsured vehicle driver strategies, accident defense, and clinical settlements coverage. auto. In the table listed below, you can discover more concerning the fines drivers could deal with if they do not preserve appropriate insurance coverage.

For the most current info, it's ideal to get in touch with your state's DMV or division of insurance policy. Along with penalties and also license as well as possibly registration suspensions, there could be other repercussions for driving without vehicle insurance policy. For example, some states may confiscate your certificate plates, seize your vehicle, or include indicate your driving record.

Below are a few ideas to help make certain you do not inadvertently have a gap in protection. Paying late or missing a payment might cause a termination notice from your insurance policy business.

The Definitive Guide to States Where You Might Not Have To Get Car Insurance

Liability Insurance policy covers injuries that you, the marked driver or policyholder, cause to a person else. State car insurance policy legislations normally call for medical coverage that pays for the treatment of injuries to the driver and travelers of the insurance holder's vehicle.

Underinsured vehicle driver protection comes into play when an at-fault driver does not have enough insurance to pay for your failure (automobile). This protection might likewise protect you if you're hit as a pedestrian. To ensure you're fulfilling your state's insurance coverage legislation needs, get a car insurance quote or work with an insurance policy representative near you and also make certain you have the appropriate level of protection.

insurance companies risks auto car insured

No, all states do not call for cars and truck insurance coverage, but all require monetary obligation to operate a vehicle on the roadway. Every state needs that you meet monetary duty demands through insurance, a bond or some various other accepted methods that reveal you are able to pay if you cause problems to an additional individual or building in a vehicle mishap. credit score.

/Insuring_Your_Car-42b77ff9ab8f4f4e88c0be99031a3d12.png)

laws vehicle insurance car insurance cheapest auto insurance

New Hampshire possibly has the least quantity of demands-- and also it still requires that you immediately show proof of monetary obligation if you've been entailed in an automobile mishap. If you pick to get insurance policy, as most drivers do, all 50 states have various minimum insurance policy requirements.

The Top 10 What States Don't Require Car Insurance ... Statements

cheapest business insurance car insurance cheap car

https://www.youtube.com/embed/5l6yvjUgvXk

State legislations as well as minimum insurance coverage needs differ substantially, which has a big effect on what you pay. In some states, drivers can not sign up an automobile without showing proof that they have liability insurance policy, while other states just require evidence of insurance policy when upon request-- generally indicating when a vehicle driver has an accident or gets a ticket.